Claiming VAT on Mileage

- Xero Queen

- May 13, 2024

- 2 min read

One question I get asked quite often is whether it is okay to claim VAT on mileage claims made by employees and directors.

Good News

If you are the owner of a VAT registered business and aren't using the flat rate scheme and you and or your employees claim the approved mileage rates then, yes you can reclaim VAT on the fuel element of your mileage expenses.

It isn't complicated but there are rules to follow. You must only be paying the HMRC approved mileage rates, at the time of writing these are £0.45 and £0.25. So why are there two rates and how do you know which to use? This is very simple up to 10,000 miles in a year the amount is £0.45 after this it drops to £0.25, HMRC deems that at 10,000 miles you have had sufficient contributions to the wear and tear running costs and from this point only the fuel part is claimable.

The employer can pay more than the HMRC rates but if they do the employee will get taxed on the difference and the employer pays less you may be able to claim tax relief on the difference.

Approved Mileage Rate

HMRC publish approved mileage rates, which are subject to change although they have been set at 45p/25p for many years now.

As long as you are paying these rates for mileage claims you can claim back the VAT on the fuel element.

What is the fuel element then? Well HMRC publish advisory fuel rates each quarter in March, June, September and November so you must ensure you check to see what the latest rate is.

So here's how it works in practice

At the time of writing this blog (May 2024) the fuel element that you can claim VAT on if you drive a petrol car with a 2400cc engine is 24p per mile.

The 24p is VAT inclusive so you need to work backward to find the VAT claimable. This is how you do this:

24p represents 120% essentially it is 100% plus VAT so to work out the VAT only element you will need to do the following calculation 24/120*20 this will give you 4p. So for every business mile that you claim 45p you can reclaim 4p in VAT.

This may not seem a lot however when you add in some numbers you may think differently.

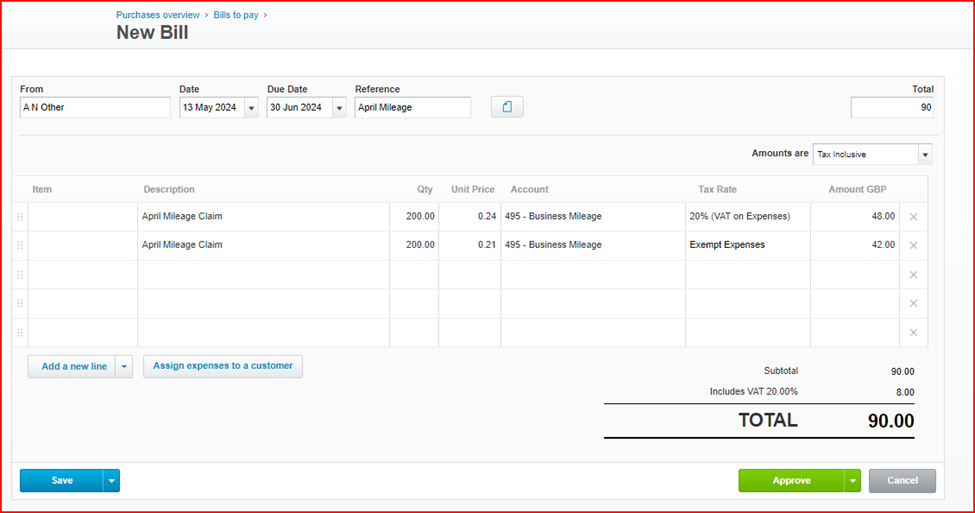

If, for example we are claiming 200 miles at 45p per mile with the fuel element of 24p per mile the total VAT to be reclaimed is £8. Multiply this by several mileage claims from employees each month and there could be significant VAT savings to be made.

How to account for this on your bookkeeping

How you put this into your bookkeeping will depend on the software you are using, we advise our clients to use Xero and posting this correctly in Xero is a breeze.

Please see sample below.

There is one thing that you should be aware of, HMRC insist that you have enough petrol receipts to cover the amount of the VAT claim. So if you are claiming (as in our example) £8 of VAT you must have £48 in petrol receipts.

Further Reading

Comments